The European Union’s Deforestation Regulation (EUDR) will strongly affect the US and Canada. In the US alone, it will limit market access for 3.5 billion dollars in US forest-derived products entering the European Union annually. This does not, however, change the fact that support for deforestation measures in North America is steadily growing and new opportunities may arise. For example, the EUDR is very progressive in its traceability requirements which can kickstart new ambitions in this area. It can also provide the perfect opportunity for companies in Canada and the US to identify their impact on the ground.

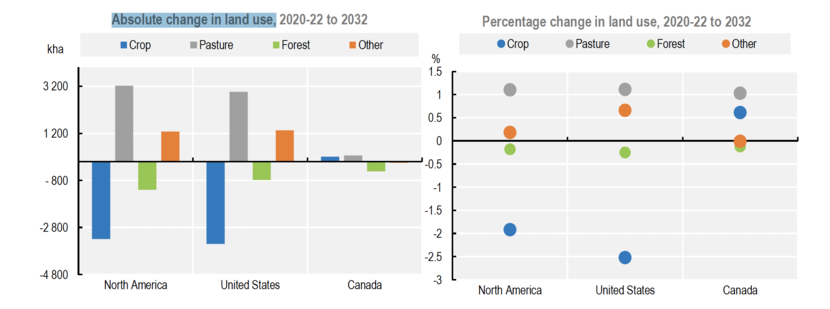

North America consists of the United States of America (US) and Canada. Both countries are huge trade and investment partners for the European Union (EU) and both countries are large markets for agricultural exports. North America comprises only 5% of the world’s population but has a significant amount of land. Even though both countries have highly diverse economies with a low share of agriculture, forestry, and fisheries in the total gross domestic product (below 2%), they together are responsible for 7% of greenhouse gas emissions in the world, related to agriculture. These emissions are expected to rise by 1.5% in the next 10 years (OECD/FAO, 2023).

North America’s efforts on deforestation

Forest protection is also an important issue in North America. The Biden administration in the US has been involved in conversations to support the mature and old growth forest initiative [1] and a forest mapping initiative. The need for supply chain traceability is increasing in both Canada and the US, as companies, suppliers and purchasers are facing pressure to disclose their impact on forests.

Democrats in the US Congress are advocating for legislation similar to the EUDR: the FOREST Act. [2] The effort is led by the Democratic US Senator Brian Schatz of Hawaii. The main driver of this proposed legislation in following the EUDR, is to prevent becoming a dumping ground for commodities that can no longer be exported to the EU. The act does not go as far as the EUDR, as it solely aims to combat illegality and illegally sourced materials. Currently, there is bipartisan support for the FOREST Act.

We are seeing other sustainability actions in the US, such as the efforts of policymakers in California and New York to include boreal forests in bills. These efforts aim to protect forests by ensuring sustainable procurement of forest-risk commodities. Similarly, in 2022, the Governor of Colorado passed an executive order that requires state agencies to prevent primary forest degradation.

‘The EUDR will kickstart transparency, something investors and customers have been requesting’

Push back on the EUDR

Global Canopy [3] stated that the EUDR rules will strongly affect at least 37 large US-based companies, who are also part of the 500 largest companies globally. This includes companies such as Starbucks and Kellanova (formerly known as Kellogg) (Hogler, 2023). They are not the only companies that will feel the EUDR impact. A group of 27 US Senators sent a letter to the United States Trade Department to express their concerns about the EUDR on the US paper and pulp producers. In the letter they explain that the EUDR requirements will limit market access for 3.5 billion dollars in US forest derived products entering the EU annually.

The geolocation traceability requirement is also a cause for concern. In the US, 42% of the wood fiber used by pulp and paper mills comes from wood chips, forest residuals, and sawmill manufacturing residues. These are wood sources that cannot be traced back to an individual forest plot. According to these senators, it is nearly impossible to comply with the EUDR traceability requirement for a significant segment of the US paper and pulp industry.

Is deforestation even an issue?

Although forest protection is a current issue in North America, there are parties denying the severity of deforestation in North America. The Canadian Government, for example, states that there is no deforestation or forest degradation in Canada. However, recent peer-reviewed papers reveal that industrial logging in Canada has been degrading forests.

Similarly, the US paper and pulp industry states that US forests are very healthy and stable. Some 67 state representatives, led by Republican Congresswoman Michelle Steel, wrote a letter at the end of last year stating the following:

'The United States does not have a deforestation problem. The industry needs your engagement with the European Commission (EC) and EU member states to insist upon EUDR implementation that focuses on countries in which illegal deforestation is occurring, and more accurately aligns regulatory and documentation requirements with the U.S. supply chain and production practices. The United States has a strong foundation in sustainable forest management and supports international efforts to address deforestation. However, without recognition of different regional factors that drive deforestation, the EU’s regulation imposes impractical requirements that would unnecessarily restrict trade for products from low-risk countries that have responsibly managed supply chains, such as the United States.' (Congresswoman Steel, 2023)

However, many previously logged areas in North America are not recovering, even decades after the logging act which directs the US Forest Service to develop regulations that limit the size of clearcuts, protect streams from logging, restrict the annual rate of cutting, and ensure prompt reforestation.

‘Democrats in US Congress are pushing for similar legislation to the EUDR: the FOREST Act’

The National Resources Defense Council’s perspective

According to the Global Policy Manager for the Global Northern Forests Program in the National Resources Defense Council (NRDC), challenges and opportunities posed by the EUDR really go hand in hand. The EUDR is very progressive in traceability requirements, which could kickstart new ambitions in this area. Major suppliers around the world have been able to report transparently on their supply chain for a while now, but there was never the need or will to do so. The EUDR provides the perfect opportunity for companies in Canada and the US to identify their impact on the ground. The US recently started looking at their impact with respect to the regrowth of forests. However, the key metrics are not yet tracked. The EUDR is an opportunity to start doing so in the supply chain.

In Canada, the situation is a bit different. According to the NRDC, the country is not leveraging their most nuanced detailing imaging, and they are not paying attention to primary forests either. In the past, there has not been a lot of political will when it comes to forests. However, market pressure is growing in Canada as well.

The NRDC also states that their corporate contacts are very much welcoming the EUDR. Companies have increasing requirements to report on climate impact, biodiversity, and their carbon footprint. The EUDR will kickstart transparency; something investors and customers have been requesting. Purchasers often also welcome the new measures, as they want to align (themselves) with international standards. In the long term, this will benefit many companies. In fact, the NRDC disclosed in 2020, that 67% of the Procter and Gamble shareholders are in favor of combating deforestation and primary forest degradation. A similar situation occurred in 2022 with stakeholders from The Home Depot, a home improvement retail corporation. Investors are increasingly recognizing that their companies will face huge risks if they do not pay close attention to what is happening on the ground, especially since climate change is damaging the resilience of forests and wood supply is declining due to wildfires and insect infestations.

Action required for different sized companies

Whether one might deny the existence of deforestation in North America, or is a champion in forest protection, it is clear to both sides that the EUDR will have an effect in North America. It will impact both large companies and small and medium-sized enterprises (SMEs). However, the obligations for SMEs will not come into action until mid-June of 2025. Also, the obligations for SME traders have been simplified by the EUDR as they are not required to carry out the due diligence themselves. Instead, SMEs are allowed to obtain the due diligence statements from other traders or operators from whom they obtain the products. However, small companies from the US and Canada with customers who do have stricter EUDR-obligations will still need to provide information and cooperate to remain in business.

Large companies in the US and in Canada will need to demonstrate due diligence to prove that their products are in fact not causing degradation of forests or deforestation. They will also need to prove that any ingredient or part of their product has been produced with compliance to environmental regulations, land-use rights, and laws regarding human rights, labor, and tax.

For companies to do that, they will have to audit their supply chains. This increased traceability across supply chains may be costly and time-consuming, as companies that trade in one of the seven commodities or their derivates, will need to ensure transparency and accountability. If companies fail to comply to the EUDR, it is very likely that this will disrupt their business. It could cause their shipments to be blocked and companies will be fined.

Demonstrating due diligence and auditing supply chains

So what does it mean to demonstrate due diligence and to audit supply chains? First, operators and traders need to become aware of their regulatory compliance, environmental sustainability, and supply chain traceability. To do that, companies can start by considering what their supply chain entails, and how this supply chain may be exposed to the EUDR. It is important for companies to map out their supply chains and gain data in terms of due diligence. This may mean extensive audits and/or identifying where they can use additional data such as satellite imagery. We are seeing that large companies are now asking satellite data companies to help them with the monitoring of land use to provide evidence in their due diligence journey.

New innovations regarding the EUDR are popping up. For example, a US company called Intercontinental Exchange is building a platform to provide support with information collection and – exchange, risk assessment and risk mitigation. [4] This company is working closely with a Dutch company, Meridia. [5] This is a great example of opportunities for trade between the Netherlands and the US, kickstarted by the EUDR!

How can the LAN team in Washington DC help?

The agricultural team at the Dutch embassy in Washington (LAN team) is always available to help with uncertainties about the EUDR and provide additional information. We also connect companies in North America with relevant partners in the Netherlands.

An important tip for companies in the US and Canada who trade with the EU, is to keep a close eye on the expected guidance from the EC. [6] The EU will publish a FAQ document and it is expected to further explain the EUDR. The EU will also publish a guidance document in the near future. The date of publication is as yet unknown.

More information

Would you like more information on the EUDR and how it will impact North America? Please go to the country pages of Canada and the US at the website Agroberichtenlandbuitenland.nl of the Dutch Ministry of Agriculture, Nature and Food Quality. You can also send an e-mail to the agricultural team at the Dutch Embassy in Washington at was-lnv@minbuza.nl or the Netherlands Consulate-General in Vancouver at van-lnv@minbuza.nl.

Bibliography

- AF&PA. (n.d.). AF&PA Supports Congressional Engagement on European Union Deforestation Regulation. Retrieved from American Forest & Paper Association: https://www.afandpa.org/news/2024/afpa-supports-congressional-engagement-european-union-deforestation-regulation

- Congressional Research Service . (2020). U.S. Trade Concerns Regarding the EU’s Farm to Fork Strategy.

- Congresswoman Steel, M. (2023). Steel House Government. Retrieved from https://steel.house.gov/media/press-releases/steel-leads-letter-ustr-demanding-update-eu-deforestation-regulations

- Directorate-General for Environment. (2024). Regulation on Deforestation-free products. Retrieved from https://environment.ec.europa.eu/topics/forests/deforestation/regulation-deforestation-free-products_en

- Hogler, D. (2023). U.S. Companies Face EU Deforestation Rules on Coffee, Wood and Other Everyday Goods. Retrieved from WSJ Sustainable Business: https://www.wsj.com/articles/u-s-companies-face-eu-deforestation-rules-on-coffee-wood-and-other-everyday-goods-a7d9207f

- Mackey, B., Campbell, C., Norman, P., Hugh, S., DellaSala, D., Malcolm, J., & Desrochers, M. (2023). ssessing the Cumulative Impacts of Forest Management on Forest Age Structure Development and Woodland Caribou Habitat in Boreal Landscapes. Land 2024.

- OECD/FAO. (2023). OECD-FAO Agricultural Outlook 2023-2032. Paris: OECD Publishing.

- Tompkins, L. (2021). Hundreds of Companies Promised to Help Save Forests. Did They? NY Times.

- United States Senators, B. K. (2024). Letter of US Senators to The Honorable Katherine Tai, The Honorable Thomas J. Vilsack and The Honorable Gina M. Raimondo.

Footnotes

[1] Mature and Old Growth Forests | US Forest Service (usda.gov)

[2] Fostering Overseas Rule of Law and Environmentally Sound Trade Act

[3] A data-driven not for profit organization that targets the market forces destroying nature

[4] www.ice.com/iba/commodity-traceability-service

[5] www.meridia.land/

[6] environment.ec.europa.eu/publications/frequently-asked-questions-deforestation-regulation_en