Foto GPS Data analysis and farmer plot registration in preparation of EUDR at UGACOF Uganda.

As Uganda faces rapid deforestation, with forest coverage dropping from 54% in 1900 to just 12.5% in 2020, the European Union’s Deforestation Regulation (EUDR) poses new challenges and opportunities for the nation's vital coffee sector. This regulation, requiring proof that exports like coffee do not originate from deforested land, presses Ugandan coffee traders to enhance traceability systems amid complex supply chains.

Uganda has faced deforestation issues for many years. According to Uganda’s national forestry plan, in 1900, 54% of Uganda’s surface was covered by forests. In 2020, this was estimated at 12.5%. Each year, Uganda loses 120,000 hectares of forest cover. That is about the size of the Dutch province of Utrecht.

Firewood and charcoal production account for about 60% of forest cover loss, with the remainder primarily resulting from agriculture and logging. To counter this development, the Ugandan Government aims at reforestation and has committed itself to stopping forest loss and land degradation. Their goal is to increase forest cover to 15% by 2025, and 21% by 2030.

Most Ugandan coffee is exported to the European market

Agriculture is Uganda’s biggest sector. It employs approximately 72% of the workforce and contributes to 24% of the Gross Domestic Product. The traditional way of farming in Uganda is small-scale. Farmers grow a variety of crops for their community or personal use, as well as for export, such as so-called cash crops like coffee.

The EUDR focuses on commodities such as cocoa, coffee, palm oil, and rubber. Of these commodities, coffee and cocoa are most relevant for Uganda, since they are big export crops. In particular, the coffee sector needs to prepare for the EUDR as the regulation will go into effect by the end of 2024. It employs about 1.8 million smallholder farmers who mainly export their coffee. The sector is responsible for 22% of Uganda’s total exports. At least 60% of the exported coffee is consumed on the European market.

Complex supply chains complicate traceability

In order to prove that their coffee is not from deforested land, as the EUDR requires, supply chain actors are preparing and improving their traceability. Between farmers in Uganda and consumers in the EU, various actors are involved, including cooperatives, traders, exporters, processors and even the government. Due to these complex supply chains, traceability will be complex as well. Therefore, coffee traders need to trace their coffee beans precisely, all the way to the smallholder farmer.

Traceability has been getting more attention within the coffee supply chain over the last years, especially with an increased consumer demand for sustainable, low carbon footprint coffee. Part of working on climate impact, is tracing where the raw materials come from, to make sure that coffee is produced sustainably. Through the EUDR, all imported coffee needs to be traceable, which also brings opportunities. The EUDR will not only incentivize the unraveling of supply chains but also foster collaboration among supply chain partners to enhance sustainability practices across the board.

The Territorial Approach as a short-term solution

In Uganda, there are different stakeholders working on EUDR preparations within the private and governmental sector. The Ugandan Government is spending 35 billion shillings (around 9 million US dollars) on coffee farmer registration. Aligning this registration with the EUDR will require time for full implementation. Because of this short deadline, the Ugandan Government and coffee traders are lobbying with the EU to accept the so-called Territorial Approach (TA).

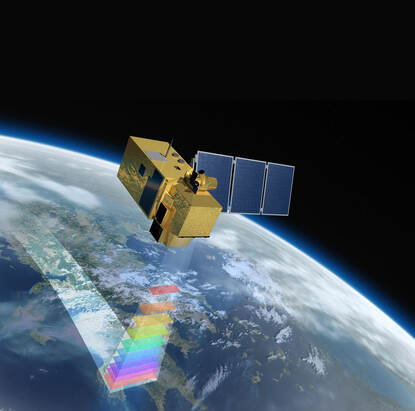

The TA, worked out by global sustainability platform Enveritas, uses high-definition satellite imaging together with artificial intelligence to show where coffee production caused deforestation. The trader knows the GPS or polygon of their supplier, and with the use of the TA, they can see which supplier cut down forests for coffee production. The TA is implemented by different countries, Uganda being one of them. It is a good short-term solution to show how substantial, or insubstantial, deforestation within the Ugandan coffee sector is.

As it stands, the TA is not enough to comply with the EUDR. Products need to be physically traceable to a plot of land, instead of only using satellite imaging. Therefore, UGACOF, one of Uganda’s coffee traders, is looking for other, substantially more costly, options to ensure traceability and EUDR compliance.

‘The Ugandan Government is spending 35 billion shillings (around 9 million US dollars) on coffee farmer registration’

Welfare loss due to the EUDR?

The question remains: who will pay for implementation of the EUDR? Unfortunately, this will be the consumer or the farmer, or both. There is a substantial risk that the high costs of implementation will lead to reduced earnings for farmers, especially if the consumer is not willing to pay the increased price due to EUDR implementation.

The EUDR should result in deforestation free coffee in the EU but should not mean welfare loss for farmers in Uganda. Decreased welfare will likely result in only more deforestation, not just for farm expansion but also for charcoal or firewood production, which will be counterproductive to the goal of the EUDR.

‘The EUDR should result in deforestation free coffee in the EU but should not mean welfare loss for farmers in Uganda’

Improved traceability provides new possibilities

That being said, improved traceability will provide new possibilities. By improving trader’s relationships with coffee farmers, especially in developing countries like Uganda, traders can lend support in more ways than just buying and selling. This improved relationship not only results in better traceability of the coffee but also more loyalty and higher quality produce. It can also improve support in other sustainability measures, such as: training farmers to increase yield, or providing support in other parts of the farmer’s life, like health insurance.

UGACOF is currently working in different East African countries on improving their suppliers’ welfare. They are creating business plans for innovations like regenerative farming, where smart intercropping results in higher yield, as well as carbon sequestration.

In conclusion, the effect of the EUDR means that the Ugandan coffee sector needs to have good traceability. This can lead to both negative and positive effects on the relationships with their supplier, depending mostly on the costs of implementation. The way the coffee traders cope with the pressure of the EUDR deadline is critical for the positive potential the improved traceability gives for their relationship with their supplying farms.

More information

Would you like more information on the EUDR and current agricultural developments in Uganda? You can visit the country page of Uganda at the website Agroberichtenbuitenland.nl of the Dutch Ministry of Agriculture, Nature and Food Quality. You can also send an e-mail to the agricultural team at the Dutch Embassy in Kampala: kam-lnv@minbuza.nl.